18+ Bi weekly mortgage

A Biweekly mortgage is a loan in which payments are made every two weeks instead of monthly. You can create your own schedule or calculator to stay on track with your mortgage biweekly.

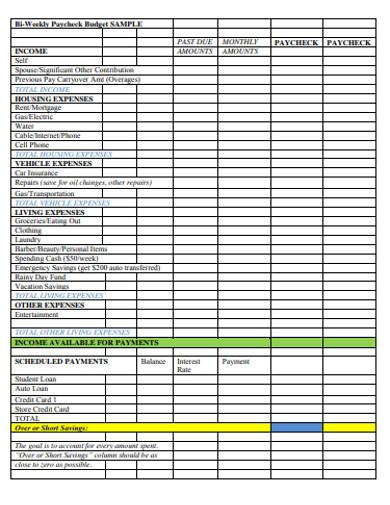

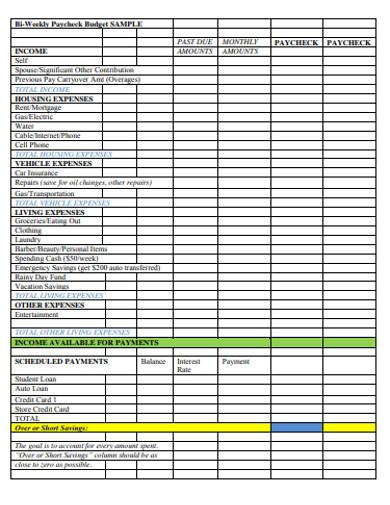

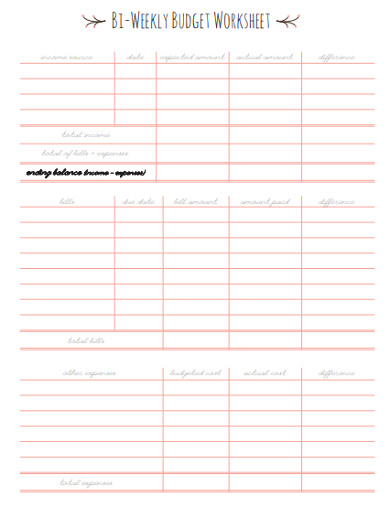

10 Free Bi Weekly Budget Templates Word Excel Docformats

Ad Use Our Comparison Site Find Out Which Mortgage Company Suits You The Best.

. If you are doing biweekly accelerated already then no need to go to weekly. Compare Mortgage Options Calculate Payments. Apply Now With Rocket Mortgage.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Repay your mortgage faster. When homeowners make monthly mortgage payments they are making 12 months of principal and interest payments per the terms of the mortgage agreement.

The monthly payment is 71021. A biweekly mortgage means that the borrower is paying every two weeks or 26 half payments. In short biweekly mortgage payments are a sort of accelerated mortgage payoff system that allow you to make an extra monthly payment each year and in turn save money on interest and.

So adding those two numbers together you get the biweekly plan payment of 76939. I am not aware of any specific guidance related to bi-weekly mortgage payments. The result is effectively 13 full payments over a 12-month period accelerating.

Ad Looking For A Mortgage. You would need to look to the requirements in 102643. Even an additional 25 paid biweekly can reduce the length of your mortgage by almost two years.

Simply by performing the steps of switching to biweekly payments and directing an. Bi-Weekly Mortgage Calculator This calculator will show you how much you will save if you make 12 of your mortgage payment every two weeks instead of making a full mortgage payment. Apply Online To Enjoy A Service.

Rynaissanceman 2 min. Its Easier to Budget. One-twelfth of that would be 5918.

5 Steps in Making Biweekly Mortgage. 102643 c 5 Payment calculation. Pay Off Your Mortgage Faster.

Together with your other homeownership expenses your. Were Americas 1 Online Lender. As you apply for a mortgage loan you wait for confirmation.

If you are doing straight bi. According to the example your regular principal and interest PI payment is 116752 while the bi-weekly payment is 58376. If you have a 200000 mortgage at 3 for 30 years biweekly payments will save you 14280.

Accumulate equity faster by paying more principal. Elevate your Bankrate experience Get insider access to our best financial tools and content. Pros and Cons of Making Biweekly Mortgage Payments Pro 1.

Payment options include monthly semi-monthly bi-weekly weekly accelerated bi-weekly and. Highest Satisfaction for Mortgage Origination. You May Save on.

Ad Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Its A Match Made In Heaven.

Bi Weekly Budget 4 Examples Format Pdf Examples

Bi Weekly Budget Template 5 Free Excel Pdf Documents

8 Best Images Of Weekly Budget Worksheet Free Printable Bi Weekly Personal Budget E Budget Template Printable Budgeting Worksheets Printable Budget Worksheet

Household Budget Worksheet Simple Monthly Budget Template Simple Monthly Budget Temp Budgeting Worksheets Monthly Budget Template Budget Template Printable

Bi Weekly Budget Template 5 Free Excel Pdf Documents

Bi Weekly Budget Template 5 Free Excel Pdf Documents

10 Free Bi Weekly Budget Templates Word Excel Docformats

Free 9 Mortgage Statement Samples And Templates In Pdf

Bi Weekly Budget 4 Examples Format Pdf Examples

Mortgage Madness Sweepstakes Presented By Wfcu Credit Union Ecu

10 Free Bi Weekly Budget Templates Word Excel Docformats

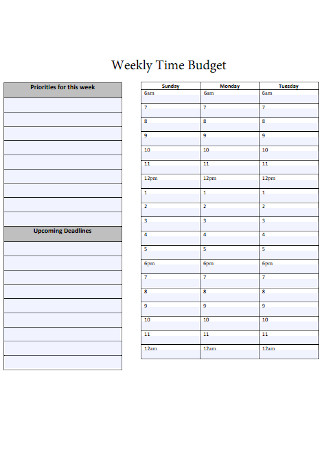

18 Sample Weekly Budgets In Pdf Ms Word

Free 9 Mortgage Statement Samples And Templates In Pdf

Free 9 Mortgage Statement Samples And Templates In Pdf

Free 9 Mortgage Statement Samples And Templates In Pdf

18 Sample Weekly Budgets In Pdf Ms Word

Bi Weekly Budget 4 Examples Format Pdf Examples